capital gains tax changes 2022

Its the gain you make thats taxed. Capital Gains Tax is currently charged at a flat rate of 18 for basic rate taxpayers.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

. Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. 500000 of capital gains on real estate if youre married and filing jointly. 1 day agoHunt is also looking at increasing the headline rate of capital gains tax.

If you sell stocks mutual funds or other capital assets that. 0 to 41675 for singles 0 to 83350 for married filing jointly 0 to. 1 day agoOne option on the table is an increase in the headline rate of capital gains tax applied on profits of the sale or disposal of shares and other property as well as changes to.

Capital Gains Tax Rates In 2022. 2022 capital gains tax calculator. A capital gain is the profit a person makes when they sell an asset for more money than it cost to acquire that.

Although the capital gains tax rates for long-term investments which are those youve held. 1 day agoMr Hunt is looking at raising the dividend tax rate and a cut to the tax-free dividend allowance in a 1bn-a-year tax raid on pensioners business owners and the self-employed. There may well be some form of change to Capital Gains.

What can you do about. However it was struck down in March 2022. 2023 capital gains tax rates.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. 4 rows Rocky Mengle Senior Tax Editor. He Chancellor is looking at raising taxes on the sale of assets such as shares and property as he weighs up difficult decisions to address a 50 billion black hole in the public.

The tax rate on most net capital gain is no higher than 15 for most individuals. The IRS typically allows you to exclude up to. 21 hours agoThats about 15 of all UK tax receipts.

For single tax filers you can benefit. 7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Put simply CGT is a tax that the government levies on capital gains. Are the tax rates changing for 2022. According to the UK Government CGT is a tax on the profit when you sell or dispose of something an asset thats increased in value.

When you include the 38 net investment income tax NIIT and some state income taxes you could be looking at a 48 all-in capital gains tax rate by January 1 2022. The finance minister is reviewing changes to the headline rate reliefs and allowances on CGT while also. 250000 of capital gains on real estate if youre single.

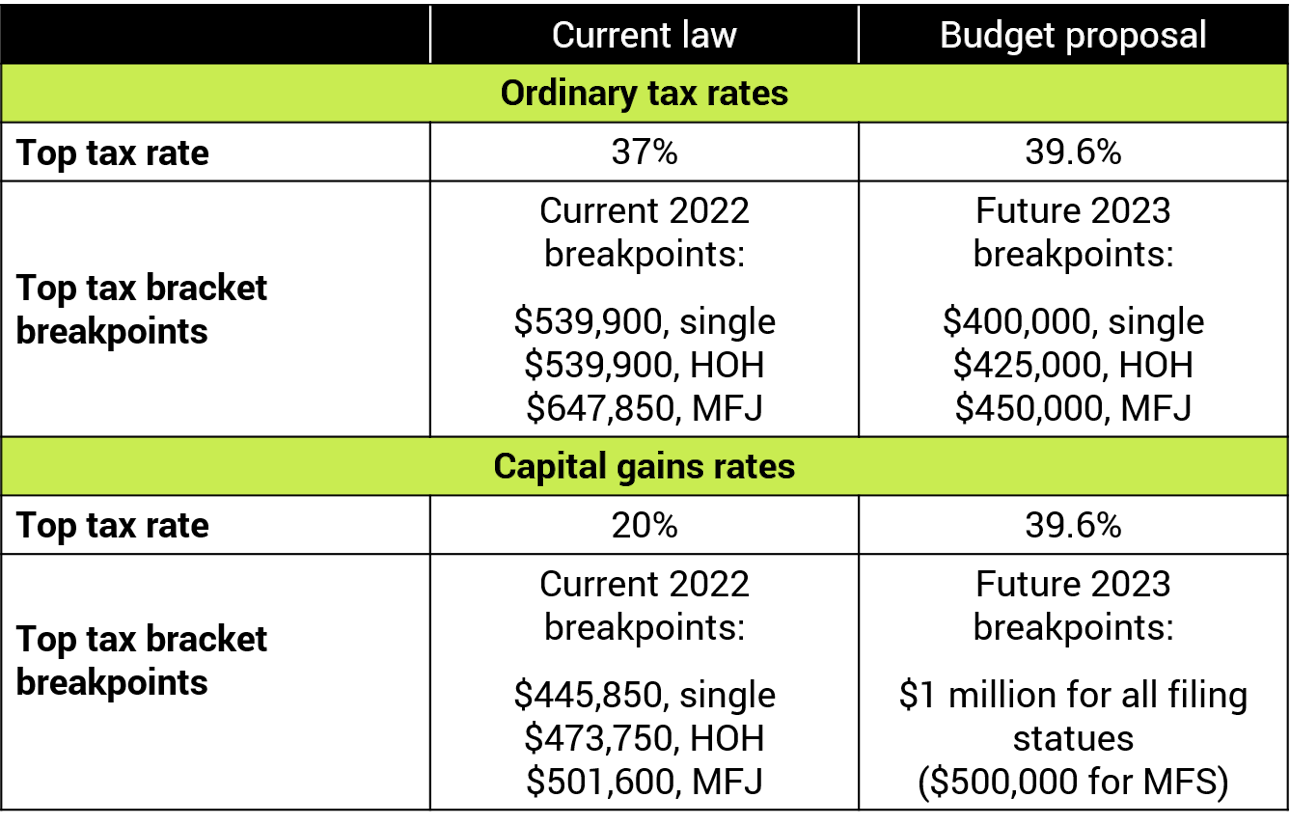

Capital Gain Tax Rates. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued. Some or all net capital gain may be taxed at 0 if your taxable income is.

2022 capital gains tax rates. Tax Changes and Key Amounts for the 2022 Tax Year. These are the capital gain taxes you can expect to pay in April 2023.

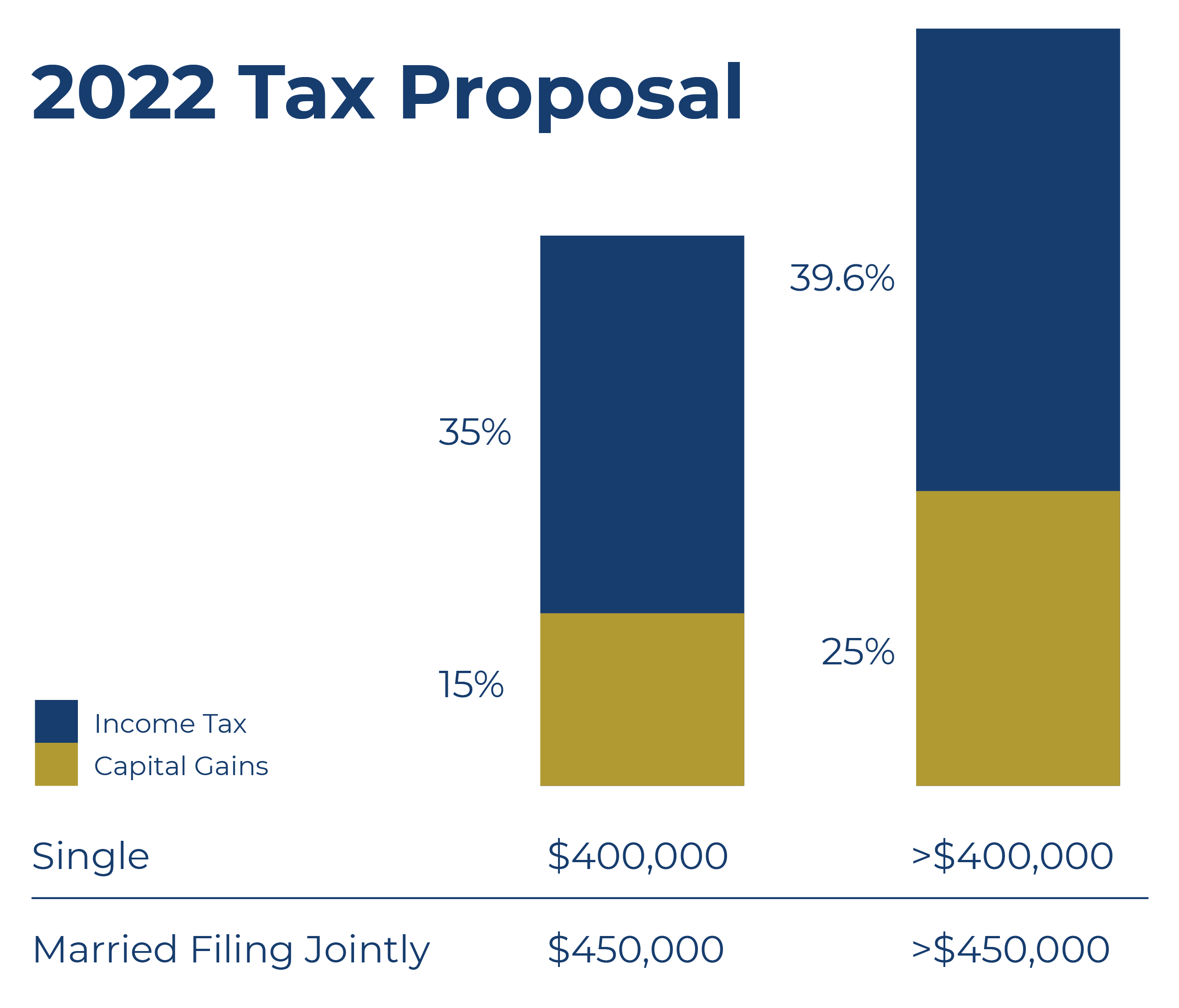

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. And starting from January 1 2022 the bill proposes to realign the top 25 capital gains rate threshold with the 396 personal income tax rate.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties

Short Term And Long Term Capital Gains Tax Rates By Income

American Families Plan Tax Proposal A I Financial Services

Brief Support Fair And Simple Capital Gains Taxes

Washington Capital Gains Tax And Long Term Care Payroll Tax New Taxes And Planning Opportunities In 2022 Merriman

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Summary Of Fy 2022 Tax Proposals By The Biden Administration

The Tax Impact Of The Long Term Capital Gains Bump Zone